Investments in biotechnology are most impactful when made by those with deep pockets. The aim of the game is to make a return on investment, which can only occur when biotech companies can create a profitable product. Without funding from angel investors/venture capitalists, many biotech companies cannot continue to meaningfully function. Analysis of the recent downward spike in global markets may be an indicator that it is about to be very difficult to raise capital to continue research into therapeutic production.

What caused the dip?

There are a few factors that have played into the concerning activity in markets globally. Firstly, investors often are very reactive to prospective changes that cause a loss of value. Pressure has arisen in the US and Japanese markets due to the upcoming US elections and interest rate hikes in Japan. Both of these factors, according to Mobius Capital Partners CEO Mark Mobius, are not technical in nature, but rather a result of geopolitical uncertainty. When investors smell poor liquidity risk, which can be generally defined as the inability to access cash, there is a tendency to see a net selling on markets, causing value of shares to drop. The Japanese “carry trade” is another example of something impacting the stock market, with its unwinding impacting the US economy by slowing investors buying into US markets with relatively cheap assets, causing a run-on effect that has led to a crash.

How does this impact Australia?

More often than not, western markets are dictated by the activity of the US markets. Recession fears in America have supposedly been a long time coming, with the ASX losing $160bn in value as a result of occurrences on the US stock exchange. Our markets are linked to those in the United States due to heavy cross-influence between our dollar and theirs. Many such cases of Australian investors having interest in assets tied to US markets. As a result, fluctuations in the stability of the US economy may be reflected onto Aussie markets.

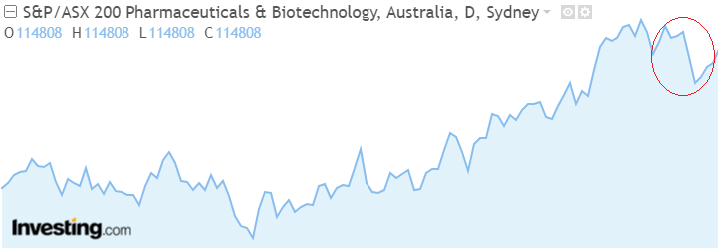

What does this have to do with Aussie biotech?

Biotechnology is often seen as one of the most volatile markets one can invest in. Companies in the space are often entirely dependent on positive clinical trial results which are hidden to outside traders until publication. As a result, there is a heightened risk when investing into biotech companies. Without funding from both wealthy investors and public traders, production of therapeutic goods may be stifled, causing companies to crumble. We saw this last year when interest rates rose to such great heights in Australia, with many individuals being a lot more bearish with their investing activity. This alone caused lots of financial stress in not just the biotech sector, but the Australian markets at large. To combat this issue, biotech companies need to obtain large amounts of liquidity to burn, with this often being a signal to a company’s health for the foreseeable future. When the money runs out, there is little that can be done to keep corporations afloat, especially when there isn’t much value elsewhere. Furthermore, recessions usually spell bad news for biotechnology. With a reduced access to money, people aren’t able to make risky investments with a lot of confidence. Again, without investment, biotech cannot function as an industry.

Summing it up (tl;dr)

A downturn in the market is not great for biotechnology. The US market greatly influences the Australian market, which is often magnified in biotech. Companies in this sector are reliant on investment, which is firmly reduced in bearish economic conditions. An upcoming recession is the last thing the Aussie biotech sector needs if the production of therapeutics is to continue.

Do you want to see more articles like this one? Let us know! We here at Biostache strive to make our content tailored to the interests of our readers, so any feedback is welcome. For more articles on biotech finance, check out Dan’s recent article on his stock picks from earlier this year.

Disclaimer:

This article is not financial advice, the information contained within this post has been provided as general information only. The contents have been prepared without taking account of individual objectives, financial situation or needs. Please make informed financial decisions.