In light of the recent rally of Mesoblast’s (ASX:MSB) stock price, we dive into the factors that have impacted the Sydney-based cell therapy company. It’s a story of patience, focus and belief that should be observed by anyone in need of a feel-good story this summer.

The Science of RYONCIL

Mesoblast is a clinical-stage biotechnology company that specialises in stem cell science to treat patients for steroid-refractory acute graft versus host disease (SR-aGVHD), inflammatory bowel disease (IBD) and the COVID-19-related respiratory disease, ARDS. Their technology involves mesenchymal lineage adult stem cells (MLCs), a form of mesenchymal stromal cell (MSC). MSCs are naturally found in bone marrow, peripheral blood and adipose tissue.

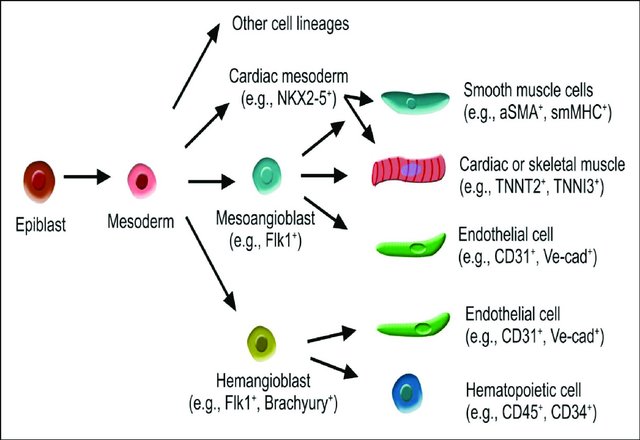

Mesoblast have been able to extract MLCs from healthy, adult donors to harness their tissue repair potential. The mesenchyme, by the way, is formed from the mesoderm, a germ layer that eventually becomes our bones, muscles, blood vessels and more. As such, MLCs have been found by Mesoblast, fronted by CEO and founder Silviu Itescu, to have the potential to treat diseases without first-class options.

The Journey

The main indication for their MLC-based therapeutic, RYONCIL (aka remestemcel-L), is for SR-aGVHD, where FDA approval was recently achieved. Mesoblast bought remestemcel-L from Canadian biotechnology company Osiris Therapeutics in 2013. Mesoblast’s goal for Ryoncil is to fill the gap in the market that exists for the treatment of aGVHD, which arises as a complication in approximately 50% of patients who receive allogeneic bone marrow transplants for the treatment of blood cancers such as leukaemia.

Tribulations

It has not always been an easy road for Mesoblast. Their stock price has, as for many biotech companies, been at the mercy of FDA approval for many years. Mesoblast’s Ryoncil has come agonisingly close to approval twice to no avail, once in 2020 and once in 2023. In late 2020, the FDA’s ODAC (Oncolytic Drugs Advisory Committee) voted 9:1 in favour of approval for RYONCIL on the basis of satisfactory clinical trial results.

However, ODAC argued that not only was an additional trial required, but further scientific evidence to support the positive correlation between RYONCIL and SR-aGVHD. The 2023 Biologics Licence Application (BLA) resubmission was rejected by the FDA on the basis that more evidence was needed for the therapeutic’s success in treating SR-aGVHD in high-risk, high-mortality adult groups. These FDA knockbacks caused financial and stock market woe for Mesoblast, with the 2023 rejection forcing a slight financial reshuffling.

Success

In July 2024, Mesoblast announced that, after further consideration, RYONCIL had enough data from already completed phase 3 clinical trials conducted by the company. It seems that the decision came after a review of the focus of RYONCIL, that being paediatric patients, with Mesoblast delivering strong evidence that they could be the only manufacturers of a therapeutic for SR-aGVHD designed specifically for children. With the BLA now approved, the next step was to confirm market approval, which was announced in December last year.

Summary

Trials, tribulations, clinical trials, regulatory tribulations. Climbing the mountain of rejection isn’t easy for any company to come back from, let alone a public biotech company based in Sydney. Despite all of this, Mesoblast pushed through the doubt and financial struggle that accompanies FDA knockbacks to be the producers of the groundbreaking MSC-based therapeutic, RYONCIL.

Disclaimer:

This article is not financial advice, the information contained within this post has been provided as general information and opinion only. The contents have been prepared without taking account of individual objectives, financial situation or needs. Please make informed financial decisions.